Financial Services

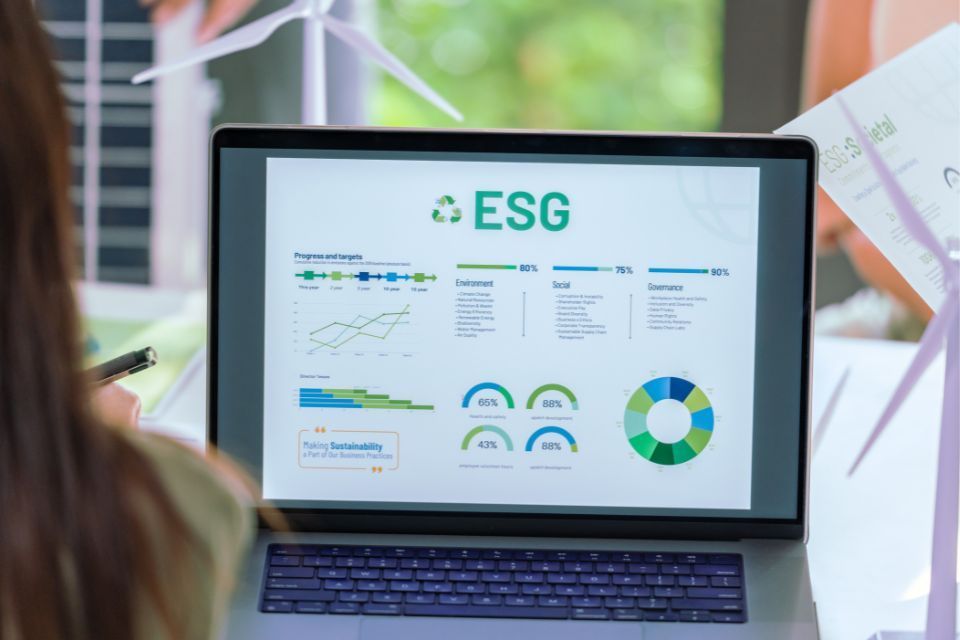

i-Prove delivers customised ESG reports and tailored insights to help financial institutions drive sustainable growth, manage risks, and ensure regulatory compliance.

Drive green investment

Leverage AI to identify high-potential green projects, streamline ESG assessments, and optimize resource allocation, driving profitable and impactful sustainable investments.

Meet consumer and regulatory demands

Align with consumer values by offering sustainable financial products, enhancing transparency, and building trust with environmentally-conscious stakeholders.

De-risk your portfolio

Mitigate climate and market risks with i-Prove's AI-driven tools for climate risk analysis, dynamic modelling, and enhanced ESG due diligence to ensure portfolio stability.

Build a sustainable future

i-Prove will ensure your business is sustainability-aligned, monitor real-world impact, and contribute to global goals like GRI and the UN SDGs to build long-term resilience and value.

When it comes to ESG reporting, the financial services industry faces a range of unique challenges. Explore these key obstacles below and discover how i-Prove can help overcome them effectively.

Opening up ESG to SMEs

ESG challenges for the financial services industry

The financial services industry faces rapidly evolving ESG regulations across different regions and jurisdictions. Keeping up with these changes while aligning internal processes to ensure compliance can be resource-intensive and challenging.

Complex and Evolving Regulatory Requirements

01

ESG data often comes from diverse sources with inconsistent formats, making it difficult to ensure accuracy and comparability. This lack of standardization hampers effective reporting and informed decision-making.

Lack of Data Quality and Consistency

02

Implementing comprehensive ESG strategies requires specialized knowledge and dedicated resources. Many financial institutions, especially SMEs, face challenges in recruiting qualified professionals and allocating sufficient resources to meet ESG objectives.

Resource and Expertise Constraints

03

Institutions face the challenge of integrating ESG considerations into investment decisions without compromising profitability. Achieving this balance requires advanced analytics and strategic insights, which are often lacking.

Balancing Profitability with Sustainability Goals

04

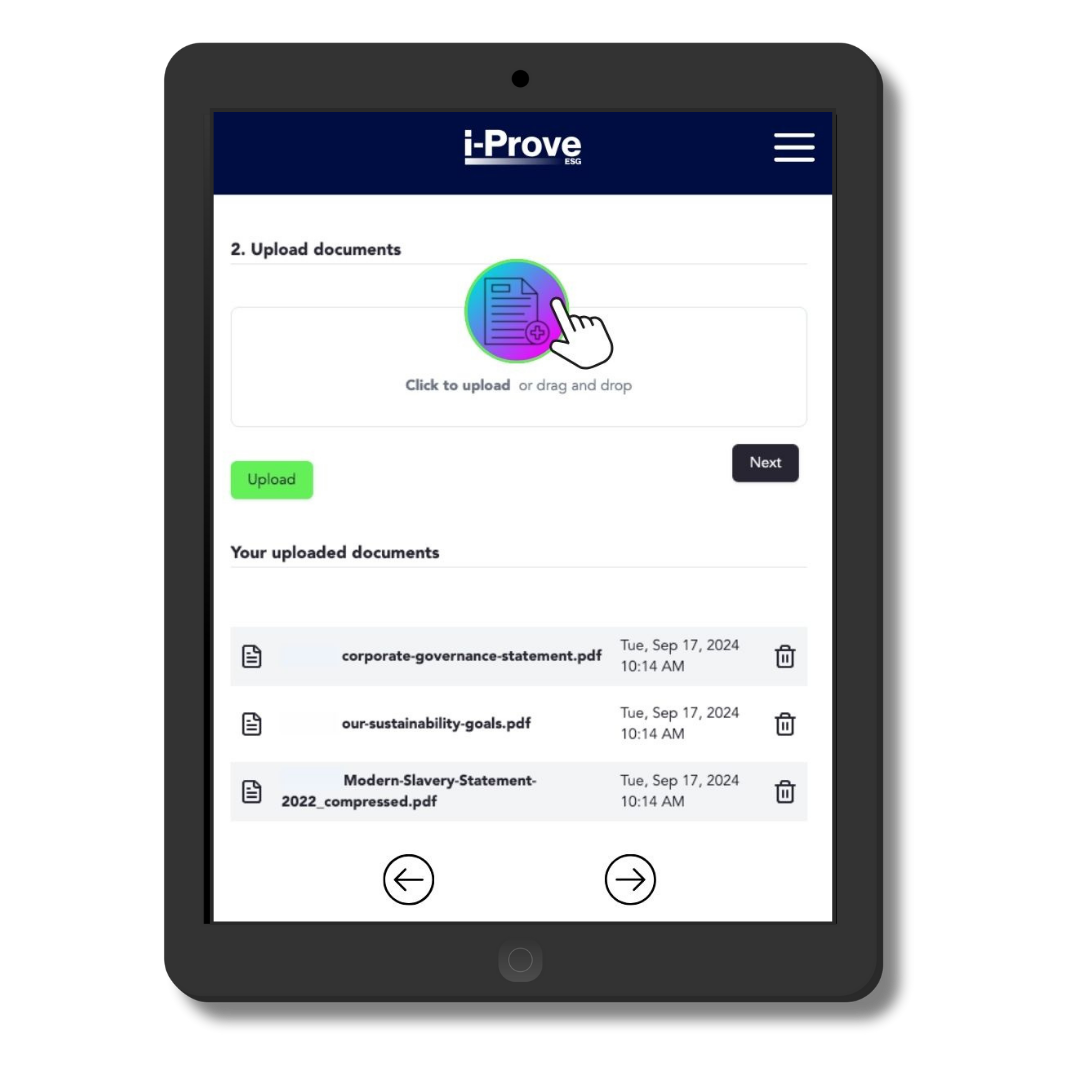

Simple, secure, and convenient.

See How Tower Leasing did it ...

Facing increasing investor demands and not knowing where to start, Tower Leasing transformed its ESG strategy by partnering with i-Prove.

With a tailored ESG report, integrated risk assessments, and a customised governance framework, they secured a £27m investment, improved transparency, and built a foundation for ongoing ESG compliance and performance tracking.

Businesses all over the UK use i-Prove.

Testimonials

Fully-managed ESG package helped us secure vital funding!

"i-Prove's hands-on approach transformed our ESG governance and enabled us to meet pressing investor demands. Their detailed risk assessments and customised ESG reports allowed us to secure vital funding while embedding sustainable practices into our everyday operations."

Kerry Howells

MD

ESG reporting made easy and simple!

"i-Prove has been pivotal in our journey to become a leader in ESG within the telecom sector. Their comprehensive approach helped us integrate sustainability into every aspect of our operations while exceeding the ESG expectations of our partners and suppliers."

Philippa Bailey

MD